Extended period of the pandemic could have an impact on the quality of the assets and adversely affect their business.ģ. The company requires substantial capital for their business and any disruption in their sources of capital could have an adverse effect on their business, results of operations and financial condition.Ģ. On account of their domain expertise to underwrite self-employed customers with limited income proofs, the company has been able to effectively serve customers, grow their business and create a business model that is difficult to replicate in their geographies.ġ. Since Aptus Value Housing Finance primarily caters to self-employed customers, many of who are new to credit and do not have formal in-come proofs such as pay slips or income tax returns, the company assess their income through various methods and conduct a cash flow assessment of their income to determine their ability to repay loans. Loans to self-employed customers accounted for ₹29,308.79mn, or 72.05% of their AUM, while loans to salaried customer accounted for ₹11,368.83mn, or 27.95%, as of March 31, 2021. The company targets first time home buyers where the collateral is a self-occupied residential property. Their in-house sourcing model helps them make a better credit evaluation of customers on a wide range of parameters after collating all customer information in their database.ĭomain expertise built over time resulting in a business model difficult to replicate by others: It has also helped mitigate underwriting and default risks by enabling the company to have a customer base with a better credit profile. The direct sourcing model has helped the company maintain contact with their customers and establish strong relationships with them, led to customer referrals, high levels of customer satisfaction and increased loyalty.

In-house operations leading to desired business outcomes:Īptus Value Housing Finance conducts all aspects of their lending operations in-house including sourcing, underwriting, valuation and legal assessment of collateral and collections, which enables the company to maintain direct contact with their customers, reduce turn-around-times and the risk of fraud. As a result, the company is well positioned to capitalize on growth opportunities and cater to the housing finance requirements of their target customer base in these geographies. These four states have high per-capita incomes, better financial literacy and GDP growth rates. According to the CRISIL Report, the company had the largest branch network in south India among the Peer Set, as of March 31, 2021. Presence in large, underpenetrated markets with strong growth potential:Īptus Value Housing Finance is one of the largest housing finance companies in south India in terms of AUM, as of March 31, 2021, with presence in the states of Tamil Nadu (including the union territory of Puducherry), Andhra Pradesh, Karnataka and Telangana. Some of the competitive strengths are as follows This is evident from the fact that Aptus Value Housing enjoys collection efficiency of 99.20%. Hence, they ensure to make their EMI payments on time, even in the midst of tough financial conditions. The company has implemented a robust risk management architecture which is reflected in their asset quality. The company has repeatedly pointed out that this self-employed entry level segment is normally very cautious about credit records since they cannot afford to be blacklisted in the credit market in any form. Aptus Value Housing Finance target first time home buyers where the collateral is a self-occupied residential property and does not provide any loans with a ticket size above ₹2.50 million. The company offers customers home loans for the purchase and self-construction of residential property, home improvement and extension loans loans against property and business loans.

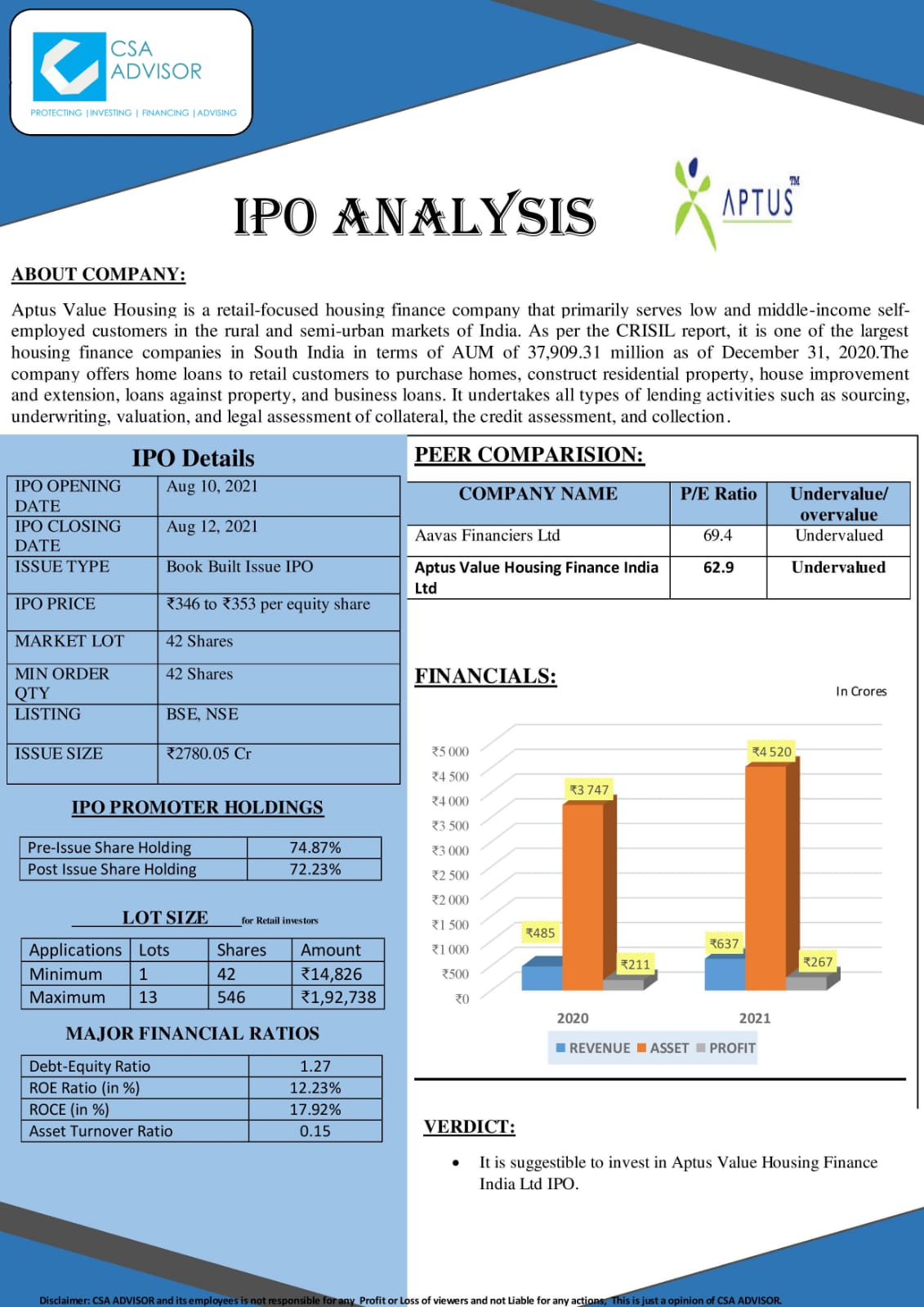

The company is one of the largest housing finance companies in south India in terms of AUM, as of Ma(Source: CRISIL Report). Aptus Value Housing Finance India Limited is an entirely retail-focused housing finance company primarily serving low and middle-income self-employed customers in the rural and semi-urban markets of India.

0 kommentar(er)

0 kommentar(er)